Most credit cards offer a free Extended Warranty benefit. If your new laptop, phone, or refrigerator malfunctions, and you’re past the 90-day manufacturer warranty, the credit card might kick in where the manufacturer does not. People will often pay for a warranty extension when purchasing electronics and appliances, they probably don’t realize that such coverage comes free on many credit cards!

Many popular credit cards will give an extra one or two years of warranty protection, with up to $10,000 of coverage. The extended warranty benefit is offered by most banks including Amex, Chase, and Citi. Details will vary by issuer and card.

You don’t need to register the purchase for this benefit. When something goes wrong and needs repair or replacement, simply file a claim, send in all documentation requested, and the bank will either pay for a repair, send you a new one, or reimburse you for the original purchase price.

Credit card coverage only kicks in if there’s a manufacturer’s warranty to begin with. An item with no manufacturer’s warranty will get no warranty at all from the card issuers.

Here are some additional details which are typically true across all cards and issuers:

Here are some common exclusions from the benefit: animals, live plants, consumables/perishables like food, perfume, light bulbs, batteries, cars, boats, items purchased for resale or commercial use , services, cash equivalents like gift cards, tickets, books, magazines, jewelry, seasonal items, used items, medical equipment, and computer software.

These exclusions are just a sampling, and even these may vary by bank. For example, not all banks have the medical equipment exclusion. Normal wear and tear is almost always excluded, though Amex and Chase apparently don’t have that exclusion.

Used items are not covered, even when sold by the manufacturer, with a warranty. Manufacturer refurbished items will probably be covered if they come with a manufacturer warranty.

Where things start getting confusing is if you purchase an extended service contract either from the manufacturer itself or a third-party provider. Citi, Amex, and Visa signature are clear that their warranty benefit will simply begin after the purchased contract expires. Chase’s terms are a bit vague, but it sounds like you’ll lose out on the Chase warranty when buying any sort of contract (“this benefit is secondary to any service contract or Extended Warranty you have purchased or received”).

A similar question arises with someone who has homeowners insurance but prefers to file with the bank instead of their insurer: Citi is clear that the benefit is primary (everywhere with the exception of New York state); Chase also states clearly that you can file with them even if you have insurance (but not if you have any sort of service contract on the item itself); Amex is ambiguous on this issue.

What if the manufacturer offered no warranty at all? Amex and Visa Signature clearly will not cover such a scenario; Chase and Citi probably won’t cover this scenario either.

Visa Signature and Mastercard World seem to allow your store-purchased warranty to count and trigger the extended warranty benefit, while all the other banks seem to require a manufacturer’s warranty to trigger the benefit.

Many Amex credit and charge card have an Extended Warranty Protection benefit, personal card and small business cards alike, which doubles the manufacturers warranty up to 12 months. (It was briefly 24-months, but now back to 12 months starting 1/1/20.)

The following cards will lose their Extended Warranty coverage beginning January 1, 2020: Blue from American Express, Amex EveryDay, Cash Magnet, Blue Cash Everyday. All other cards have the 12 month coverage mentioned. (The Centurion/Black card gets 3 years of extended warranty, from what I understand.)

Keep in mind the limitations of Amex’s warranty. (1) They’re only doubling the manufacturer’s warranty, it’s not always a full year of extra coverage. Many manufacturer’s warranties are 90 days, and Amex will only match that, not more. (2) They only double the manufacturer warranty (whether free or purchased), but not secondary/supplementary warranty purchased from an outside company.

How to File a Claim

To file a claim, go to this link and click Enter Claims Center Now to file. Or call 1-800-225-3750 to file a claim with a human. File a claim within 30 days or as soon as reasonably possible.

Most Chase cards come with one year extended warranty protection. This is better than Amex’s offering since Chase will always add a year onto the manufacturer’s warranty on all warranties of 3 years or less while Amex only matches warranties of less than two years.

How to File a Claim

To file a claim, go to this link to file a claim. Or call 1-888-320-9961 to file a claim with a human. File a claim within 90 days.

Most Citi cards come with 24 month extended warranty protection. Citi has by far the best Extended Warranty protection since they offer 24-months of extra protection regardless of how long the manufacturer’s warranty is.

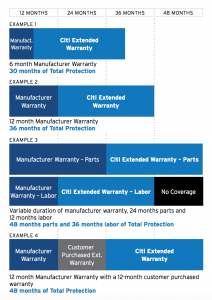

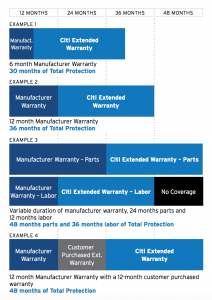

Here’s a nice graphic from Citi to explain it all:

How to File a Claim

To file a claim go to Citi Benefits Center or call 1-866-918-4670 to file a claim with a human. All requested documentation must be completed within 180 days.

Discover no longer offers this benefit as of February.

Visa Signature cards (irrespective of issuing bank) offers a Extended Warranty benefit to double the manufacturer’s warranty up to 1 year. If the manufacturer’s warranty is more than 3 years, no extended warranty is offered.

A nice thing about the Visa Signature benefit is that they seem to count a store-purchased dealer warranty or assembler warranty as well. For example, if the manufacturer does not have any warranty and you purchase a 1-year store warranty, you’ll get the second year covered by Visa.

Basic Visa cards do not have any Extended Warranty benefit, unless the bank decides to offer it on their own.

How to File a Claim

To file a claim, go to the dedicated website or call 1-800-551-8472. File a claim within 60 days. Many individual banks may have alternative methods

Bank of America extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Barclay’s extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all. And these benefits may have been removed completely, effective November 2019.

Capital One extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

Wells Fargo extended warranty runs with standard Visa and Mastercard benefits with 1 year additional assuming a manufacturer warranty of 3 years or less. As noted, these depend on the card, and some cards may not have the benefit at all.

In the end, it boils down to the following five options: Amex, Citi, Chase, and Visa Signature.

Citi is the clear winner for best the Extended Warranty benefit since they’ll always give you an extra 2 years, even on a 90-day or 1-year manufacturer warranty. While Amex recently enhanced their benefit to two years, it only helps on a 2-year warranty, not on a one-year warranty (though it might help for Apple products with AppleCare).

For your typical 90-day or 1-year warranty offering, you’ll do best with Citi. If the product comes with a 2-year warranty, Amex is as good as Citi. Amex seems to have the least exclusions, and may even cover some things which are excluded from other warranty benefits, such as normal wear and tear.

Remember to consider all other factors before deciding which card to make a purchase on, such as points earning, fraud protection, Purchase Protection, Return Protection, and more. Ironically, it’s usually worth putting important purchases on no-fee cards since most people don’t know how long they’ll be keeping a premium card (remember: you may be filing a claim years later), and the warranty benefit typically won’t cover if the card is cancelled.